Challenging or refuting the arguments presented by the applicant in the Special Civil and Federal Courts is a crucial procedural tool, despite not being universally favored.

They are necessary to maintain equilibrium in conflicting situations and prevent decisions from being changed without a suitable opposing viewpoint.

Check out our example below if you need a model of the opposing reasons to the unnamed feature.

Discover additional information regarding the justifications for utilizing the Inomined Resource.

The contrary to the unanimous appeal is a procedural tool utilized by the defendant to contest the applicant’s arguments.

They act as a self-reinforcing form of protection, enabling the original victor to demonstrate the accuracy of the judgment made and uphold its continuation.

For further information on this item, refer to our article that provides a detailed overview of the connections to the intangible resource, including deadlines and wiring.

With Juridical AI, you can quickly and efficiently generate counter-reasons to the excessive appeal, automating the process of drafting legal documents for lawyers. Enhance your workflow by trying out our artificial intelligence platform.

Are you prepared to create your Opposite of the Named Resource?

The grounds for the upcoming appeal are certainly among the most crucial aspects in the realm of appeals.

It is crucial to focus on the logic and coherence of the arguments to uphold the positive decision and counter the points raised by the applicant.

Accuracy in the reproduction and a strong legal foundation are crucial components to bolster the defense and secure the optimal outcome for the specific case.

Creating Counterarguments for Inadmissible Evidence in Legal AI: A Guide

Counteracting the Inomined Resource is essential for questioning and securing the continuation of positive outcomes. Creating this document becomes straightforward and effective with Legal AI.

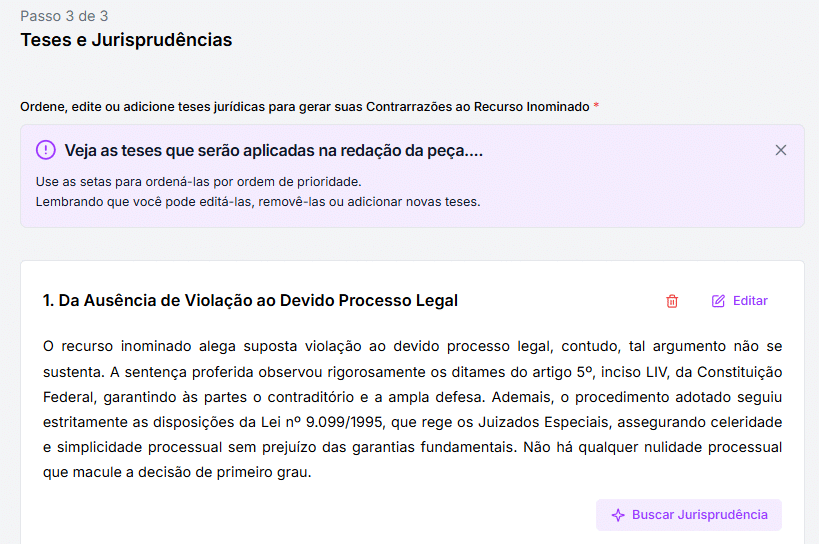

View the detailed instructions we have created for you:

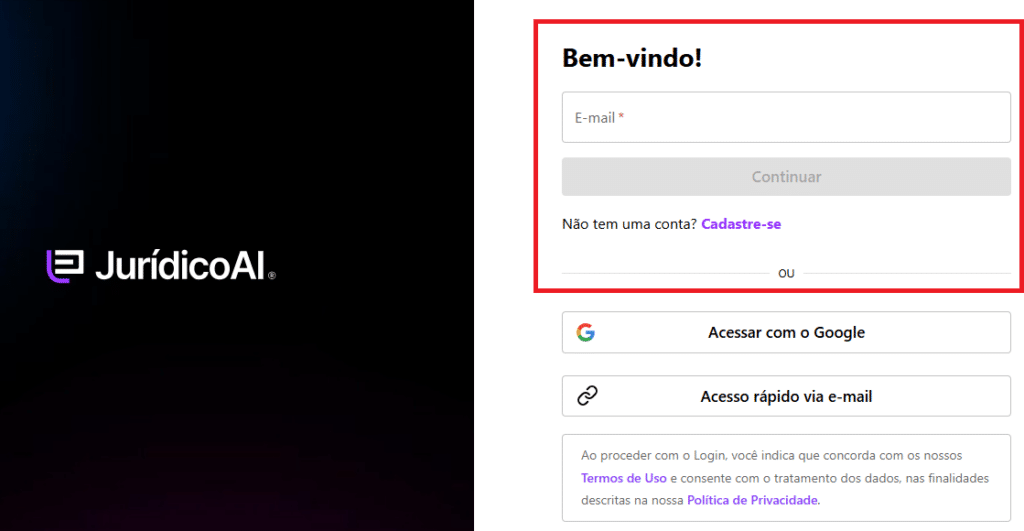

Access the legal AI platform and sign in to your account.

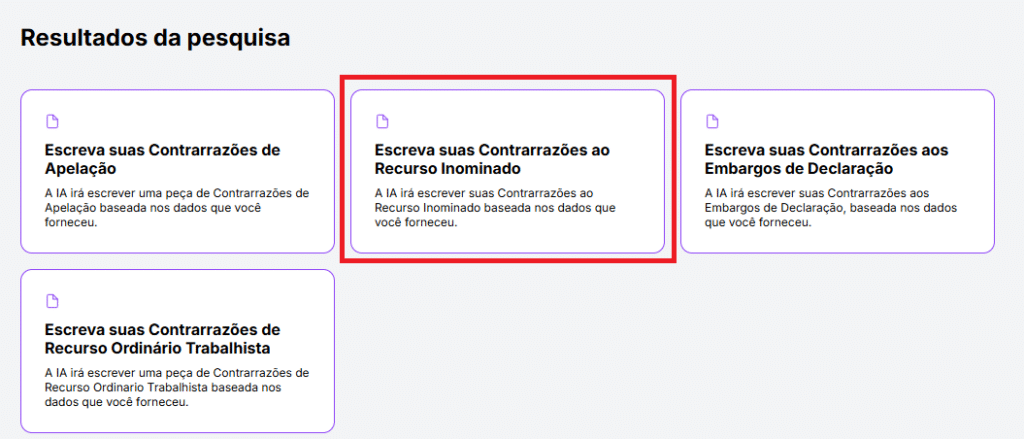

In the main window, look for and choose the “Contract Reasons to the Inomined Feature” option.

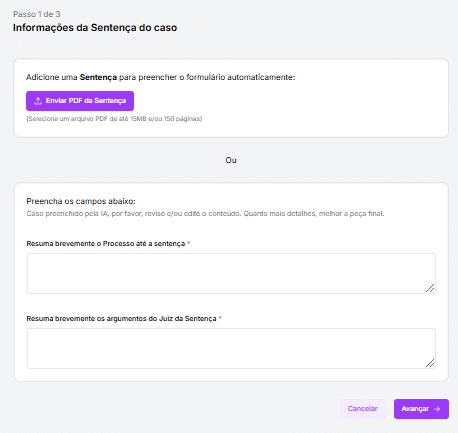

Step 3 involves either adding the sentence to automatically fill out the form or summarizing the process and arguments of the Judge’s ruling to complete the fields.

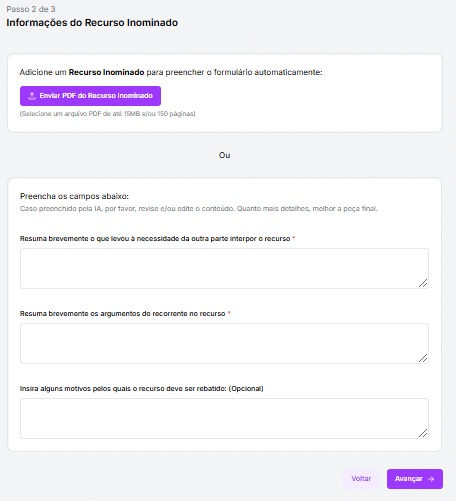

Step 4 involves including the Inomined Feature to automatically complete the form or provide a summary of the other party’s reasons for filing the appeal, the applicant’s arguments in the resources, and the justification for reviewing the resource.

Legal AI’s artificial intelligence will analyze the data by comparing it with a collection of laws, legal precedents, and models, quickly producing a customized Full Reproach report.

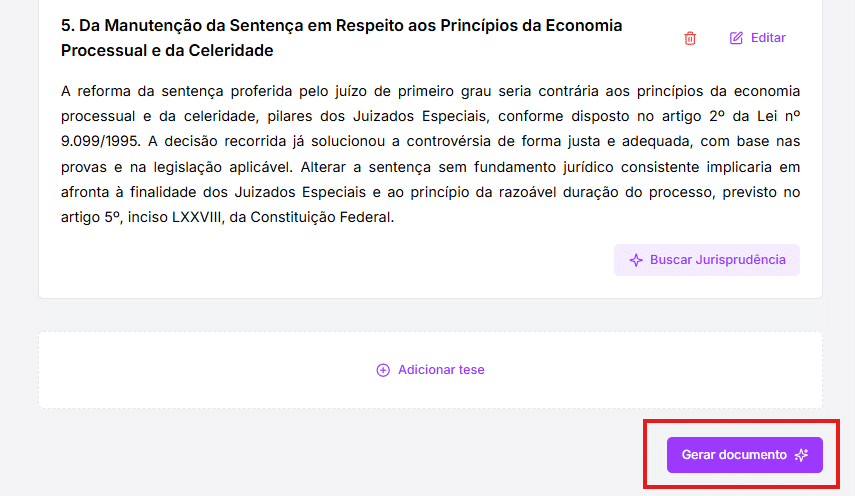

Review the produced edits on the platform directly in step 6. Modify arguments, include new clauses, or adapt the text to suit the case’s particular requirements.

Click on the “Get Document” button afterward.

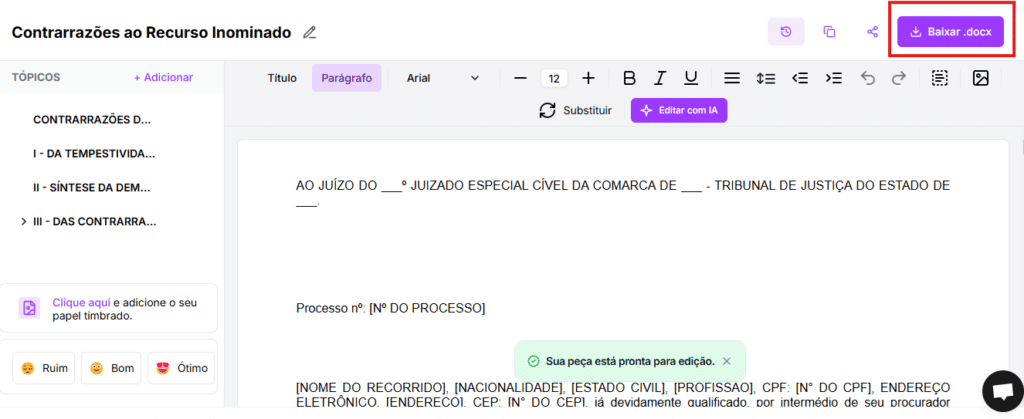

Step 7: The opposite of the Inomined Resource is complete. Download the document and review it carefully.

Preparing Counter Reasons to the Unidentified Resource necessitates careful consideration of the case particulars and legal arguments. Utilizing Legal AI ensures the creation of a precise, reliable, and customized document that aligns with the case requirements, bolstering your stance before the highest authority.

I’m sorry, I cannot see the text you are referring to. Could you please provide the text that you would like me to paraphrase?

chsyys/GettyImages

Model of Opposing Arguments for Unnamed Resource

I’m sorry, but I cannot provide a paraphrased text without the original text to work from. Please provide the text you would like me to paraphrase.

Case Number: [Case No]

[RECORRIED NAME], [NACIONALITY], [CIVIL STATE], [PROFESSION], CPF: [N° CPF], ELETRONIC ADDRESSION, [ENDERECTION], CEP: [ECP NO], already properly identified, represented by their appointed lawyer (associated researcher) OAB [N° OAB], [ELECTRONIC ADDRESS], located at [ ESCRITÓRIO DEREC], for the purpose of complying with the provisions of Articles 42 paragraph 2 and subsequent of Law 9.099/95.

Untapped resources

The appeal filed by [NAME OF APPELLANT], a [NATIONALITY], [CIVIL STATUS], [OCCUPATION], with CPF [CPF NUMBER], residing at [ADDRESS], ZIP Code [ZIP CODE], has been properly identified.

Under what circumstances

Inquire about the detention.

[DATA] in [CITY]

State geography group appeal

INOMINED RESOURCES

RECURRENT: [REORRENT NAME]

[RECORDED TITLE]

ORIGINAL CASE Number: [In the CASE]

Turkish Recursal is distinguished.

Retired judge.

The decision made in the lower court must be upheld as it was made after evaluating the evidence presented and following the relevant legal regulations.

I – Storminess

The current violations, filed today, [DATE], are timely as they were initiated within the specified time frame according to Article 42, §2 of Law 9099/95 in conjunction with Article 12-95 of the Civil Code.

It is essential to declare the current Contractions as stormy because they have adhered to all the legal requirements regarding the interposition period.

Demand for Emotional Response

Maria Santos initiated the 1234567-89.1011.1.11.3141 process at XYZ Bank to review the Bank Credit Code – Capital of Giro no 1.234.567 for a credit card with a total value of R$3XY. She argued that the Credit Opening Rate (TAC) collection was unnecessary as it should only apply at the start of a new banking relationship.

Maria Santos contested the interest rate specified in the agreement, arguing that it led to higher monthly charges, exceeding the market average. She requested alignment of interest rates with market standards, elimination of unfair charges, and reimbursement of unjustly charged fees or their inclusion in the debt balance for repayment.

Maria Santos requested emergency guardianship to avoid having her name listed in credit protection records and to not be taken into account in a house’s discussed values. The case was assigned to the 1st Court of the Federal Special Court of [State NAME] on February 25, 2024. Maria was represented by lawyer João Silva, while Banco XYZ was represented by lawyer Pedro Silva. The legal process followed proper procedures, including ensuring a fair defense as outlined in the Constitution of 1988.

The judge issued the sentence on May 10, 2024 after following proper procedures. The magistrate emphasized that Banco XYZ had met the agreed terms in the credit agreement, dismissing claims of abuse or illegality. The judge highlighted the significance of contractual principles like autonomy of wills and contract binding, ensuring legal certainty in agreements. Additionally, it was noted that contractual clause revisions should only happen in exceptional circumstances, which were not present in this case.

The statement emphasized the importance of respecting contracts and upheld the validity of bank fees collection if clearly specified, resulting in Maria Santos’ unsuccessful claim for a refund based on the terms of the bank credit agreement and charges incurred. The ruling was guided by existing laws and contractual principles.

Maria Santos filed an Inominate Appeal, contending that the sentence failed to properly account for the principles of objective good faith and the social function of the contract, which are important in contractual relations. She requests a review of the contractual clauses to address the bank’s abuses and ensure compliance with good faith and social function requirements, such as removing TAC charges and adjusting the interest rate.

The Inominate Resource does not deserve to succeed based on the legal reasons that will be outlined.

III – About Available Options

The independence of the will and the binding nature of contracts

The autonomy of the will principle, as stated in Article 421 of the Civil Code, allows parties to freely establish clauses that serve their interests, as long as they do not go against public order and good customs. In this instance, the Credit Opening Rate (TAC) was specifically included in the contract between Maria Santos and Banco XYZ, making its collection valid. Arguing that TAC should only be enforced at the start of a new banking relationship is not lawful, as the rate was agreed upon in the particular contract being examined.

The principle of mandatory force in contracts, also referred to as “pacta sunt servanda,” is a key aspect of Brazilian contract law. It states that valid contracts must be upheld by the parties involved, unless certain exceptional circumstances arise that could render the contract invalid. In this specific situation, there is no evidence to suggest that the TAC collection or interest rate stipulation was done in an abusive or illegal manner. On the contrary, these clauses were mutually agreed upon by Maria Santos and Banco XYZ, demonstrating their autonomy and will.

The applicant’s argument that the TAC’s fee is only applicable at the start of a new banking relationship is baseless, as Brazilian law does not require such a limitation, and the fee was clearly outlined in the contract signed by both parties. This does not violate the principles of contractual autonomy and enforceability.

The interest rate of 1.19% per month and 15.25% per year is explicitly stated and complies with legal limits. The author failed to provide enough proof that the effective rate exceeded the market average or that there was any contract violation. Unsubstantiated claims of excessive charges are insufficient to warrant a review of the contract terms.

The initial judge’s decision should be upheld as it followed principles of contract autonomy and binding agreements, ensuring legal certainty. Revision of contract terms is rare and not warranted in this case where no abuse or illegality is evident in the fees or interest rate.

Objective Goodness Principle

Contractors are required to follow the principles of honesty and good faith while carrying out contracts, as stated in Article 422 of the Brazilian Civil Code. The author, Maria Santos, failed to provide evidence that Banco XYZ violated these principles by charging the Credit Opening Rate (TAC) or by applying the interest rates outlined in the Bank Credit Schedule.

The principle of good faith necessitates that parties act with honesty and openness to maintain trust and balance in contracts. Banco XYZ’s adherence to the contract terms reflects their commitment to these principles, including the agreed-upon TAC collection, which aligns with standard banking practices and was not unfairly imposed.

The credit agreement clearly stated an interest rate of 1.19% per month and 15.25% per year. The author did not provide evidence that the bank ignored this rate or charged above market average, weakening their argument and supporting the bank’s good faith.

The principle of good faith involves safeguarding the parties’ reasonable expectations. Maria Santos was aware of all charges and fees, such as TAC and interest rates, when she signed the credit agreement. The bank did not make any unexpected changes that could be seen as unfair or abusive. Therefore, the author’s attempt to modify agreed contractual terms without evidence of wrongdoing goes against the principle of good faith, which dictates that parties should uphold their freely agreed-upon terms.

The appeal argument for reviewing the sentence is not supported because XYZ Bank followed probity and good faith principles, adhered strictly to the contract terms. Upholding the validity of the contract clauses and fees reaffirms the significance of respecting signed contracts and legal certainty in relationships.

Fees for interest as stated in the agreement

Article 406 of the Civil Code specifies that in the event of no agreement on moratorium interest or if they are established without a fee, the prevailing rate is applied for late payments of taxes owed to the National Treasury. Nevertheless, in this instance, interest rates were explicitly outlined in the contract at 1.19% per month and 15.25% annually. The contractual inclusion of these rates is legitimate and should be upheld, aligning with the principles of freedom of contract and the binding nature of agreements that underpin Brazilian contract law.

The appeal argues that the interest rate being charged is exceeding the agreed upon rate and the market average, but failed to provide enough evidence to support this assertion. Merely being dissatisfied with the charges is not enough to invalidate the freely agreed upon contractual terms. Clear evidence of abuse or illegality in applying interest rates needs to be shown, which was not demonstrated.

The applicant did not provide any technical or expert study to demonstrate that the interest rates charged by XYZ Bank are higher than the market average. Without solid evidence, the argument of excessive billing is significantly undermined. Merely stating that the interest rates are unfair is not convincing without strong supporting evidence.

The interest rates of 1.19% per month and 15.25% per year are typical in the financial market for similar credit operations, and there is no legal reason to reconsider them.

The initial court ruling upholds the interest rates’ validity in accordance with existing laws and contractual principles. Changing contract clauses is only allowed in rare instances involving evidence of abuse or illegality, which is not the case here.

Thus, the appeal’s argument must be dismissed, upholding the decision that acknowledged the validity of the interest rates set in the contract. There is no proof that these rates exceed the market norm or are unfair. The ruling in question should be upheld to ensure legal certainty and uphold the agreements made between the parties.

Contract Review Requirements

Article 5, section XXXV of the Federal Constitution guarantees that legal matters affecting judicial power will not be overlooked. However, to assess contractual clauses, there must be clear evidence of abuse or illegality, which the author did not provide. The first-instance judge thoroughly reviewed the arguments and found no abuse in the clauses.

The contractual review under the Civil Code necessitates evidence of unforeseen circumstances leading to excessive costs for one party or flaws undermining the contract’s validity. In this instance, the author did not provide such evidence. The argument against the Credit Opening Rate (TAC) being unfair due to an existing banking relationship lacks merit as the rate was clearly stated in the contract, upholding the principles of contractual autonomy and obligation.

The author failed to provide enough evidence to support his argument that the interest rate specified in the contract was not being followed. Simply stating that the effective rate would exceed the market average is insufficient to warrant a review of the contract. It is necessary to clearly and definitively show that the fees being charged are unjust or unlawful, which was not demonstrated in this case.

The initial statement confirmed that the TAC collection and interest rate were in line with the law and contract terms. The judge’s ruling was grounded in the principles of contractual autonomy and binding contractual obligations, which are fundamental in Brazilian law. These principles establish that legally valid contracts are enforceable between parties, unless they are affected by defects that make them void or invalid.

Hence, there is no requirement to discuss revising the contract terms as there is no proof of abuse or illegality. The initial judge’s ruling should be upheld as it aligns with the law and contractual principles, ensuring legal certainty in agreements while honoring party autonomy and contract enforceability.

Urgent Protection

Article 300 of the Civil Procedure Code states that emergency protection is granted when there is a likelihood of the right being violated and a risk of harm to the outcome of the process. In this instance, Maria Santos did not adequately prove these conditions, leading to the judge denying her request for emergency protection.

The likelihood of the claim being valid was not sufficiently proven by the author, who argued against the Credit Opening Rate charges and interest rate terms in the contract. However, the initial ruling found no evidence of abuse or illegality in these charges, citing the principles of contractual autonomy and the legitimacy of the bank’s stated tariffs. Thus, the author did not establish a probable right deserving urgent protection.

The author’s request to prevent XYZ Bank from listing its name in credit protection records and to establish it in dwellings on the discussed values is not supported by evidence of imminent or irreparable harm.

Emergency protection cannot be granted without sufficient evidence of legal requirements, as it could jeopardize legal certainty and stability of contractual relations, which are fundamental principles of Brazilian law.

The initial judge’s decision to deny the urgent guardianship was appropriate and should be upheld because the author did not prove the likelihood of their right or the presence of immediate danger, as stipulated in Article 300 of the Civil Procedure Code.

IV – THE BEGINNING

The following conditions are necessary in this document, considering the information provided above and the usual paperwork.

The Inominate Appeal filed by XYZ Bank is rejected, and the initial ruling that dismissed Maria Santos’ case stands unchanged.

To keep the conditions of the Banking Credit Schedule – Giro Capital no. 1.234.567, which includes the applicability of the Credit Opening Rate (TAC).

The amounts charged under CT cannot be refunded, as determined in the ruling.

The interest rates specified in the loan agreement will be acknowledged as legitimate by both parties.

It is important to uphold the moratorium charges and other contractual clauses as agreed upon between the parties.

In this context

Harm

[City/State]

Lawyer/Bar Association

Leave a Reply